Briseis Art Equity fund V (OAF)

A MENA Fund of unique artworks from emerging, mid-career and (re)emerging artists, chosen for their potential to appreciate in value over the investment’s term, in collaboration with Jesse Yaw Global and affiliates Inc. (Briseis Art Foundation) vision for a more equitable, just and artistic world, allowing under represented artist legacy to live on.

- Opportunistic investment strategy: We track sectors of the art market using proprietary data and analytics. We have and will continue to discover a selection of undervalued artworks by emerging, mid-career and (re)emerging artists, proving an opportunity for significant appreciation over the lifetime of the fund.

- Already allocated and expected to grow: The Fund is currently comprised of two hundred and thirty eight artworks — all purchased below fair market value based on third-party appraisals. Over the Fund’s lifetime, additional artworks by emerging, mid-career and (re)emerging artists are expected to be acquired, further boosting the Fund’s diversification.

- Demonstrated performance: The Fund’s first annual appraisal exceeded expectations, delivering a weighted average appreciation from purchase price of 68.8%. This independent appraisal illustrates progress in the Fund’s strategy of targeting enhanced returns by acquiring emerging, mid-career and (re)emerging artists artworks at or below fair market value.

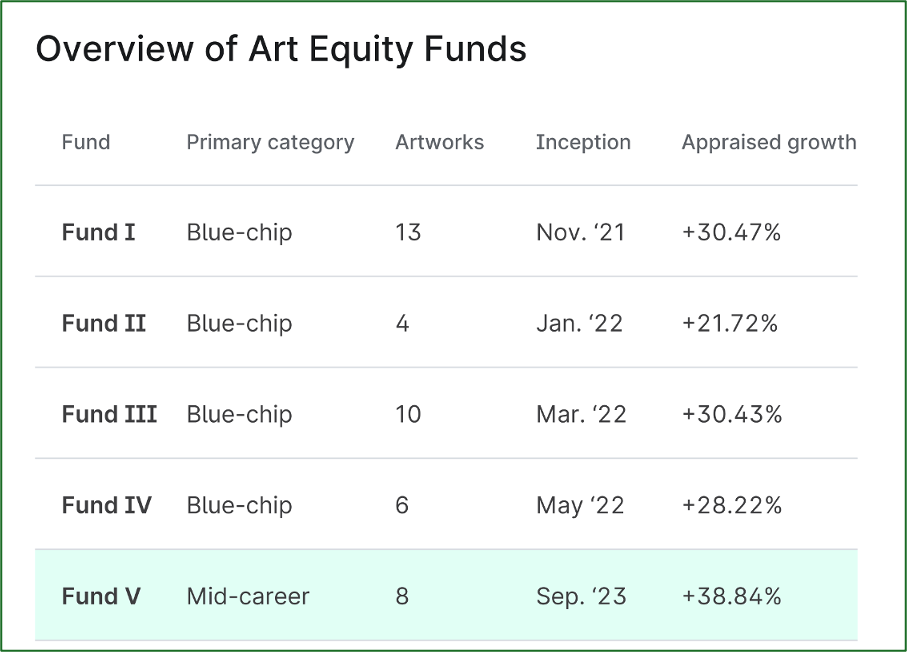

- An experienced art investment manager: Our four prior Art Equity Funds have an average appraised gross appreciation of nearly 25%, as of December 2024 (the last annual appraisal). In addition, 100% of our $63M in matured art debt investments have performed on target.

Investment details

- All artworks currently in the Fund were purchased below fair market value based on third-party appraisals. The condition of all artworks was evaluated by an independent museum conservator before purchase.

- Artworks are insured by a wall-to-wall fine art insurance policy, providing coverage up to the appraised total value for the Fund.

- We hold the artworks in specialized fine art storage facilities, except when artworks in the Fund are requested to be exhibited (e.g., by museums, major institutions or other exhibition spaces) as exhibitions tend to increase the value and passion for artworks.

- To track how the Fund is performing, a third party will conduct annual appraisals of each artwork (typically each December). The results will be published for investors.

- As the Fund nears its maturity, we usually partner with our network of galleries, advisors, dealers, and auction houses to sell each artwork in the Fund. The appreciation from each sale is passed to investors, subject to any incentive fee earned by the Manager.

Investment strategy

- OAF leverages proprietary data analytics that include both public and private sales data, information about future museum exhibitions, gallery representation, and the team’s collective experience at the intersections of art and finance — among other factors — to track thousands of artworks.

- Based on the aforementioned analysis, we will highlight mid-career and (re)emerging artists that we believe to be significantly undervalued in the current market. The Fund aims to acquire what we believe to be the most iconic images from the artists’ most important artistic series at or below fair market value, as determined by third-party appraisal.

How was the Fund curated and who is the manager?

- The Fund is managed by Ophelia Art Finance (OAF), a subsidiary of Aurelia Family Office. Ophelia has evaluated more than $3B of art and has funded more than $475M in fine art investments since its inception in 2015.

- This is OAF fifth Art Equity Fund. The prior four Funds all continue to perform in line with expectations with average appraised gross appreciation of nearly 25% as of January 2025.

- The Fund is overseen and managed by Daniel Fine and Jesse Yaw Global Affiliates Inc, acting as Co-Managing Director and Head of Art Investments at BEAF, and a team of in-house art investment professionals.

Market backdrop

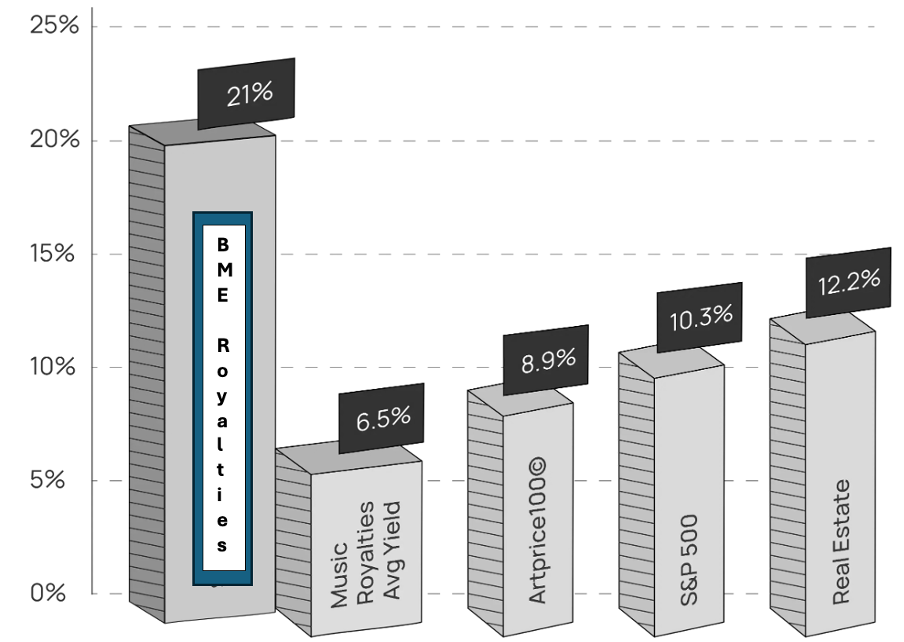

The asset class has demonstrated resilience during downturns of the past. Based on Mei Moses, the leading art index at the time of the global financial crisis, from 2007 to 2009, auction prices fell by roughly 27.2%. Meanwhile, the S&P 500 fell 57% from its peak and hit a 12-year low in early March 2009. But by 2011, total art sales matched 2007 levels. The S&P 500, by comparison, took an additional two years to reach pre-crisis trading levels in 2013, indicating that the art market has the potential to recover at a faster rate.

Art’s historically low correlation to the stock market, potentially lucrative returns, and potential ability to hedge against inflation make art investment funds a viable investment opportunity for investors looking to generate returns outside of public markets.

The diversified nature of the Fund reduces concentration risk for investors, as compared to investment in a single piece of art.

Jesse Yaw Global and affiliates Inc. and Daniel Fine

Briseis Music and Entertainment Studios Inc.

Briseis Music and Entertainment Studios Inc. (originally known as Aurelia recording and film studios) is a South African based film and television production company founded by Jesse Yaw in 2013 in a joint venture with Alex Rodriguez. The company produced documentaries based on the upbringing of Jackson and his affiliates, in a global distribution partnership.

This platform serves as integral voice of marginalised communities, marginalised voice, marginalised stories and unrepresented talent. Facilitating relationships with international distribution partners, recording studios and producers, in line with Jesse Yaw’s vision, this platform seeks to redress false narratives, perceptions, stereotypes of mainstream media and entertainment studios, by showcasing authentic and value based narratives that enhance, community, fellowship and a commitment to each other as citizens of the global village.

Jesse Yaw

Author. Poet. Philsopher.Voice for Resilience

Terms